Worksheet on Discount and Markup

In the last topic, i.e., understanding discount and markup, we learnt about markup and discount percentages and how to calculate the selling price when discount and markup are given. Here, you will have to solve some problems based on the concept of markup and discount. But before you need to keep the following formulae in your mind in order to solve problems based upon the concept of discount and markup:

1. Markup = markup percent x cost/store price

2. Selling price = markup price + cost/store price

3. Discount amount = discount percent x cost/store price

4. Selling price = cost/store price – discount amount

Now, based upon the above given formulae try to solve the following problems:

1. The store piece of a t-shirt is $50. If the markup set by the store is 30%. Calculate the markup price set by the store on the t-shirt.

2. The store price of an electronic gadget is $100. If the markup percent set by the store is 45%. Calculate the markup price set by the store on the electronic gadget.

3. The cost price of a certain object is Rs1,500. The markup percent set by the shopkeeper is 50%. Calculate the markup price and selling price of the object.

4. The cost price of a video player is $250. The markup percent set by the store is 30%. Calculate the markup price set by the store on the video player. Also, find the selling price of the video player.

5. If the selling price of a certain instrument is $300. If the markup set by the store was 20%. Then calculate the cost price of the instrument. Also, find the markup price for the instrument.

6. The store price of a jeans is $50. If the discount given by the store is 45%, calculate the discount amount offered by the store on the jeans.

7. The cost price of a mixer grinder kept in a sale is Rs3,000. If the discount offered on the grinder is 30%. Calculate the discount price that is offered on the grinder.

8. The store price of an object is $35. If the discount offered by the store is 25%. Calculate the discount amount and selling price of the object.

9. The cost price of an instrument is $350. If the discount offered by the shopkeeper is 65%. Calculate the discount amount and selling price of the instrument.

10. The selling price of a t-shirt is $95. If the discount offered by the store was 45%. Calculate the cost price of the t-shirt. Also, find the discount amount offered by the store.

11. The cost price of a music player is $150. If the owner of the store thinks to keep a markup of 45% and gives a discount of 20% of the cost price (excl. markup) of the player. Then calculate the selling price of the music player.

12. Solve the above problem if the owner decides to offer the same discount percent on the music player if the discount is kept on the cost price including the markup price. In which case the discount offered is more and by how much?

Solutions:

1. $15

2. $45

3. Markup = Rs750

Selling price = Rs2,250

4. Markup = $75

Selling price = $325

5. Cost price = $250

Markup = $50

6. $22.5

7. Rs 900

8. Discount = $8.75

Selling price = $26.25

9. Discount = $227.5

Selling price = $122.5

10. Discount = $42.75

Selling price = $52.25

11. Selling price = $187.5

12. Selling price = $174

Discount offered in case 2 is higher than that offered in case 1 and the difference between the discounts is $13.5.

Profit and Loss

Cost Price, Selling Price and Rates of Profit and Loss

Problems on Cost Price, Selling Price and Rates of Profit and Loss

Understanding Overheads Expenses

Worksheet on Cost Price, Selling Price and Rates of Profit and Loss

Understanding Discount and Mark Up

Worksheet on Discount and Markup

Worksheet on the application of overhead Expenses

Worksheet on Successive Discounts

From Worksheet on Discount and Markup to HOME PAGE

Didn't find what you were looking for? Or want to know more information about Math Only Math. Use this Google Search to find what you need.

Recent Articles

-

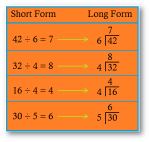

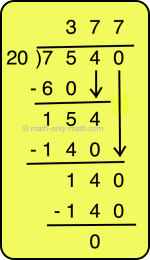

How to Do Long Division? | Method | Steps | Examples | Worksheets |Ans

Apr 20, 25 11:46 AM

As we know that the division is to distribute a given value or quantity into groups having equal values. In long division, values at the individual place (Thousands, Hundreds, Tens, Ones) are dividend… -

Word Problems on Division | Examples on Word Problems on Division

Apr 20, 25 11:17 AM

Word problems on division for fourth grade students are solved here step by step. Consider the following examples on word problems involving division: 1. $5,876 are distributed equally among 26 men. H… -

Subtraction of 4-Digit Numbers | Subtract Numbers with Four Digit

Apr 20, 25 10:27 AM

We will learn about the subtraction of 4-digit numbers (without borrowing and with borrowing). We know when one number is subtracted from another number the result obtained is called the difference. -

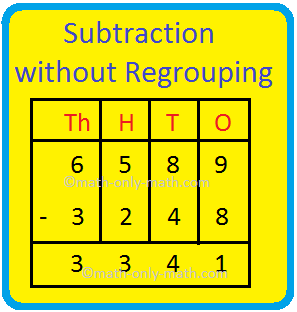

Subtraction without Regrouping |4-Digit, 5-Digit & 6-Digit Subtraction

Apr 20, 25 10:25 AM

We will learn subtracting 4-digit, 5-digit and 6-digit numbers without regrouping. We first arrange the numbers one below the other in place value columns and then subtract the digits under each colum… -

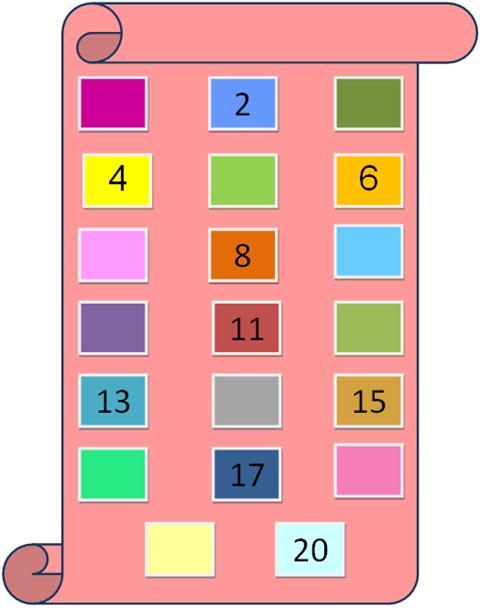

Worksheets on Missing Numbers from 1 to 20 | Counting Missing Numbers

Apr 20, 25 10:17 AM

Printable worksheets on missing numbers from 1 to 20 help the kids to practice counting of the numbers.

New! Comments

Have your say about what you just read! Leave me a comment in the box below. Ask a Question or Answer a Question.