Introduction to Compound Interest

Before going to the actual topic, i.e., compound interest, let me first introduce you the term ‘interest’. Suppose you go to a bank asking for home loan. The amount that you get from the bank as your loan is known as principal amount. The bank charges some percent on this principal amount and you have to pay this percent of amount in additional to the principal amount. This additional amount that you pay is known as interest. There are two types interests:

1. Simple interest

2. Compound interest

Under this topic, we will be studying about compound interest. Compound interest is defined as the interest calculated on both the amount borrowed (i.e., principal amount) and any previous interest. It is also known as interest on interest. Compound interest is standard in finance and economics.

Below are given some formulae used in compound interest:

Let P be the principal amount R% be the rate of interest and T be the time given to repay the amount. Then, amount to be repaid, i.e., A is given by:

I. When the interest is compounded yearly:

A = P(1+R100)T

II. When the interest is compounded half yearly:

A = P(1+R2100)2T

III. When the interest is compounded quarterly:

A = P(1+R4100)4T

IV. When the time is in fraction of a year, say 215, then:

A = P(1+R100)2(1+R5100)

V. If the rate of interest in 1st year, 2nd year, 3rd year,…, nth year are R1%, R2%, R3%,…, Rn% respectively. Then,

A = P(1+R1100)(1+R2100)(1+R3100)...(1+Rn100)

The above given formulae are sufficient to find the amount to be repaid when the interest is compound interest. We know that:

A = P + I

where, A = amount to be repaid

P = Principal amount

I = interest

So, interest = amount – principal amount

Compounding frequency:

The compounding frequency is the number of times the accumulated interest is paid in a year on a regular basis. The frequency could be yearly, half-yearly, quarterly, weekly, or even daily until the loan is completely paid along with the interest.

Look at the below given example to get a better view to calculate compound interest:

Eg. A rate of 12.5% is charged on a principal sum of $12,000. The time given to repay the amount is 2 years. If the interest is compounded annually, then calculate the amount to be repaid and interest charged in two years.

Solution:

Interest rate = 12.5%

Principal amount = $12,000

Time = 2 years

Total interest = ?

Amount = ?

We know that A = P(1+R100)T

So, A = 12,000(1+12.5100)2

= $15,187.5

Interest = amount – principal

= $15,187.5 - $12,000

= $3,187.5

Compound Interest

Introduction to Compound Interest

Formulae for Compound Interest

Worksheet on Use of Formula for Compound Interest

9th Grade Math

From Introduction to Compound Interest to HOME PAGE

Didn't find what you were looking for? Or want to know more information about Math Only Math. Use this Google Search to find what you need.

Recent Articles

-

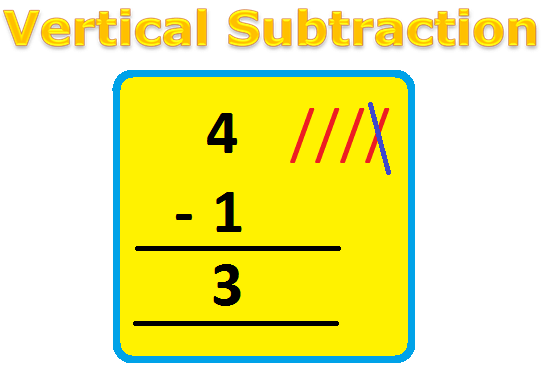

Vertical Subtraction | Examples | Word Problems| Video |Column Method

Mar 22, 25 05:20 PM

Vertical subtraction of 1-digit number are done by arranging the numbers column wise i.e., one number under the other number. How to subtract 1-digit number vertically? -

Worksheet on 11 Times Table | Printable Multiplication Table | Video

Mar 22, 25 05:08 PM

Worksheet on 11 times table can be printed out. Homeschoolers can also use these multiplication table sheets to practice at home. -

Worksheet on 10 Times Table | Printable Multiplication Table | Video

Mar 21, 25 03:46 PM

Worksheet on 10 times table can be printed out. Homeschoolers can also use these multiplication table sheets to practice at home. -

5th Grade Prime and Composite Numbers | Definitions | Examples | Math

Mar 21, 25 12:18 AM

5th grade prime and composite numbers -

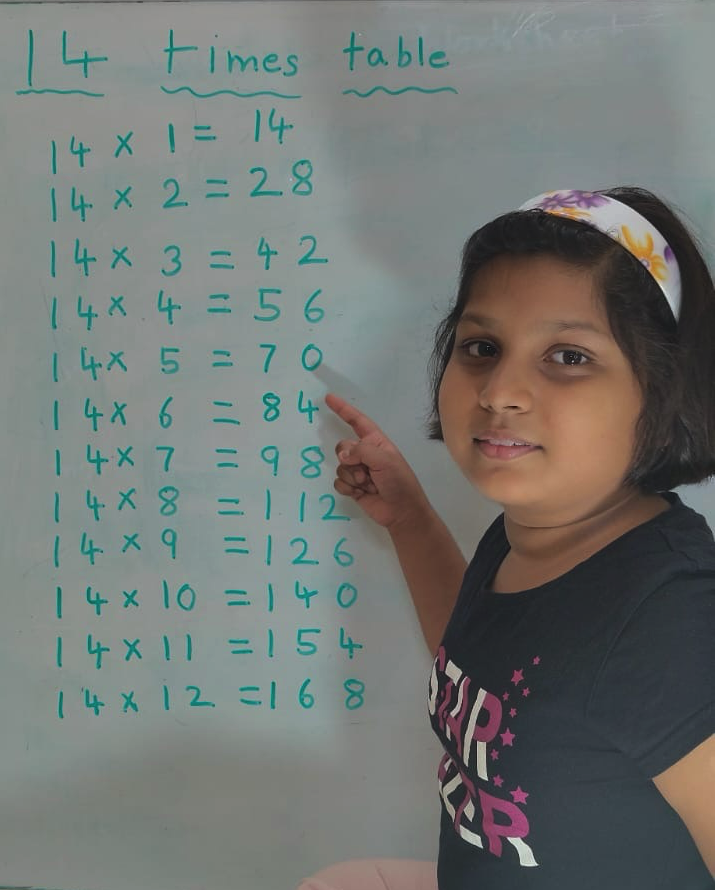

14 Times Table | Read and Write Multiplication Table of 14| Video

Mar 20, 25 04:03 PM

In 14 times table we will learn how to read and write multiplication table of 14. We read fourteen times table as:One time fourteen is 14 Two times fourteen are 28 Three times fourteen are 42

New! Comments

Have your say about what you just read! Leave me a comment in the box below. Ask a Question or Answer a Question.